Tata Trucks Vs. Ashok Leyland Trucks - Which One is Performing Better ?

By | Published Date : October 17, 2023

Commercial Vehicles in India have played a vital role in empowering the economy of the nation for the past many decades. One of the prominent factors that make trucks the first choice for transporting goods over short and long distances is the door step delivery and their ability to conquer the most difficult terrains of the country.

Tata Trucks vs Ashok Leyland Trucks

When we talk about the prominent commercial vehicle manufacturers in India, the two well-established names in the league are Tata Motors and Ashok Leyland. At the same time, you may want to know which one of them is performing better in recent times and therefore which amongst Tata truck or Ashok Leyland truck you should buy. Through this article, we bring some interesting facts that give a fair idea of Tata Trucks Vs Ashok Leyland trucks and which one is leading.

Brief introduction of Tata Trucks

The history of Commercial Vehicles in India is as old as the presence of Tata Trucks in India. Tata Motors is the oldest trucking brand in India. Moreover, across the world, Tata Motors holds 3rd rank amongst the leading truck manufacturers. Tata launched its first Mercedes Benz diesel truck, Telco in 1954. Since then there has been no looking back and today there is an entire range of trucks under the umbrella brand that make it the market leader in India. Despite so many brands in the Indian Trucks industry today (including Eicher Trucks, BharatBenz Trucks, Mahindra Trucks, SML Isuzu trucks, AMW trucks, MAN trucks, etc), out of every 2 trucks sold in the market today, 1 is still a Tata truck.

Brief introduction of Ashok Leyland Trucks

Owned by Hinduja group Ashok Leyland, it is the second largest commercial vehicle manufacturer in India and 12th largest manufacturer of trucks worldwide. Ashok Leyland also manufactures spare parts and engines for industrial and marine applications. The first Ashok Leyland truck by the company was 13-tonne truck named Tusker. Over the past decade, Ashok Leyland Trucks have emerged very aggressively and are reducing the sales volume gap with Tata Trucks. The company’s inline pump technology (perceived to be requiring lower maintenance), converted many loyal Tata truck customers into its fold in the BSIII era. And, thereafter the story continues. Since trucking is highly application based and differs from segment to segment, it would be best to analyze which brand is performing better only segment wise:

Leader in Light and Intermediate Commercial Vehicles in India

The trucks in LCV & ICV category are used for intercity or short distance interstate transportation of goods. ICV & LCVÂ segment is a stronghold of Tata Motors wherein Ashok Leyland has entered lately over the past decade and is still trying to prove its presence. Tata SFC 407 Some of the most prominent models of Tata trucks in this segment are - Tata SFC 407, Tata LPT 1109 truck. Tata 407 truck as it is commonly known in the marketplace, recently became a 30-year-old brand and is still the market leader in LCV segment. The semi-forward design of SFC 407 truck is seen as a mark of safety, trust and reliability. Without a second thought, one can easily say that even till today, Tata 407 is one of the biggest brands in Indian Trucks. Ashok Leyland is trying to remove a portion of this LCV market through its Partner truck but has been unable to do so.

Tata LPT 1109 In the ICV truck segment too, Tata LPT 1109 truck is an undoubted champion. Ashok Leyland has launched a slew of vehicles in this category under the umbrella brand of Ashok Leyland Ecomet & Ashok Leyland Boss series. Ashok Leyland Guru 1111, is a first of its kind ICV truck with 3 cylinder engine. But there is still a long way to go before Ashok Leyland trucks become a considerable player in the segment.

Ashok Leyland Guru 1111 Infact, as far as the ILCV truck segment is concerned, Tata Motors has increased it market share in 2016-17 financial year. Even the market share of Eicher Trucks has decreased by almost 1.5% in LMD trucks last year, majorly on account of the gain by Tata Motors. The company launched a slew of models in the vacant grey areas of 14 Ton and 15 Ton GVW segments, where Eicher trucks was a leader through its Eicher Pro 1114 and Eicher Pro 3015 trucks. The Tata Ultra 1518 model is gaining traction day by day.

Leader in Medium and Heavy Commercial Vehicles in India

Medium and heavy commercial vehicles are used for transportation of goods over long distances. Commonly known as the long haul vehicles, the MHCV trucks segment starts from 16 ton GVW rigid trucks and goes upto 49 Ton GVW tractors. With a rapid increase in the frequency of new industrial projects, the demand for M&HCV trucks has witnessed a significant rise. Further, this demand is expected to continue and grow further till 2019 elections. Tata Trucks lead in MHCV segment followed by Ashok Leyland Trucks. Some of the prominent Tata trucks in this segment are - Tata LPT 2518, Tata LPT 3118, Tata LPT 3718, Tata Signa 4923.S and other trucks under the Tata Signa umbrella brand. The premium offering under Tata Prima brand, also referred to as the World Truck, could not garner high volumes for itself. As a result, a lower priced, trimmed down version of the original Tata Prima was introduced and called the Tata Prima LX Series.

Ashok Leyland 3118 On another hand, Ashok Leyland Trucks is also emerging very aggressively as an equally dominant player in the MHCV trucks segment. Some of the most prominent models are Ashok Leyland 3718, Ashok Leyland 3118, Ashok Leyland 2518, Ashok Leyland U-trucks range and the Ashok Leyland Captain series.

31 Ton GVW trucks (12 wheeler trucks)

Tata Motors introduced rigid trucks with lift axle for the first time in Indian Trucking history by launching Tata LPT 3118, also referred to as Tata 12 wheeler truck. Ashok Leyland's 12 wheeler truck (Ashok Leyland 3118), was launched with a twin steering axle, perceived to be offering better load distribution. However, considering the volume of Tata 3118 with lift axle, Ashok Leyland also introduced their 12 wheeler truck with Lift Axle and rechristened it as Ashok Leyland 3118 Super LA.

Also Read : Eicher introduces 2 new CNG powered light duty trucks

37 Ton GVW trucks (14 wheeler trucks)

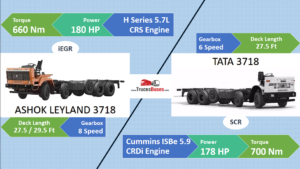

The 31 ton GVW node was surpassed by 37 Ton node within a decade, owing to better operating economics and increasing overloading restrictions by the government. This time again, while Tata LPT 3718 (Tata 14 wheeler truck) was introduced with a tag lift axle at the rear end, the Ashok Leyland 14 wheeler truck was introduced with a pusher lift axle. Ashok Leyland 3718 aroused a lot of interest from fleet owner transporters considering better load distribution and as a result Tata Motors also quickly introduced their 14 wheeler truck with pusher lift axle. Currently, both manufacturers are majorly selling the pusher lift axle model for their respective 3718 brand.

Tata 3718 Vs Ashok Leyland 3718 trucks

Rigid trucks beyond 37 Ton GVW

The increasing restrictions on overloading forced the manufacturers to conceptualize bigger trucks beyond 5 axle, 14 wheeler rigid structure offering a max GVW of 37 Tons and a payload of around 26 Ton to 27 Tons. On one side, Tata Motors worked on developing their 16 wheeler truck with 6 axles by adding a single tyre tag lift axle in the rear, offering 43 Ton GVW and named it as Tata Signa 4323.

Tata Signa 4323.T On the other hand, Ashok Leyland worked on adding some incremental GVW to the same 5 axle truck by replacing the single wheeler pusher lift axle with twin tyre pusher lift axle. This Ashok Leyland 4123, a 41 Ton GVW truck, was recently showcased at their Global Dealers Conference in Chennai. Overall, Tata trucks lead the way in the upper half of India’s geography, Ashok Leyland trucks are leaders in South India. The major reasons being brand perception & association, ease of service and resale value that has taken years together to build. Tata trucks still enjoy market leader position with 1 out of every 2 trucks sold being a Tata truck (this is despite the multiple players operating in heady duty truck markets like Eicher Trucks, BharatBenz Trucks, Mahindra Trucks, AMW trucks, MAN trucks). Over the past few years in particular, Ashok Leyland trucks have emerged quickly as a dominant player in the Indian trucks market. And there are a couple of reasons behind the above facts. Let’s analyze each of them in brief:

-

Engine & Fuel Injection System

-

Tata trucks are powered by Cummins engines and are known for their reliability and long life in the market place. Whereas the Hino technology engine with inline pump (in BSIII era) gave a major boost and a big selling proposition for Ashok Leyland trucks. With a market perception of better mileage and lower maintenance requirements, it helped convert a lot of loyal Tata fleet owners into Ashok Leyland folds.Â

-

BSIV Technology

-

Starting 1st April 2017, with the dawn of BSIV emission norms, both truck manufacturers took entirely different technology routes to meet regulatory norms related to pollution control. Tata Motors went ahead with the globally accepted and implemented SCR technology (Selective Catalytic Reduction) while requiring additional liquid urea based solution (ad-blue or DEF) for regular consumption, leading to increased operating costs. On the other hand, Ashok Leyland trucks were equipped with Exhaust Gas Recirculation based iEGR technology, which doesn’t require any additional expense of regular ad-blue consumption, by sending back a portion of the exhaust gases back to engines combustion chamber. In a country where diesel theft is a well-accepted menace, traditional transporters took some time to adapt to SCR technology and this gave the much-needed first mover an advantage over Ashok Leyland trucks. The same is also reflected in sales numbers in the first quarter of 2017-18. However, initial concerns about ad-blue availability have dwindled down slowly and Tata trucks have come back very aggressively, with sales numbers increasing month on month. The biggest advantage in favor of Tata trucks is its wide-spread network of dealers and workshops. There is a Tata authorized workshop every 35 Kms on an average, which gives a major boost to the brand against other players, including Ashok Leyland.

-

- The local road-side mechanics are also well versed with repairing Tata trucks quickly in case of a breakdown. In fact the easy availability of spare-parts in the local market also goes in favor of Tata trucks.

- Resale value This is a big advantage in favor of Tata trucks (except in southern parts of the country).

Conclusion

We all are aware of the fact that every technology has its own advantages as well as limitations. Both brands face their own challenges too. While Tata Motors has a challenge to retain its market share, Ashok Leyland is trying all things possible to convert loyal Tata customers into its fold. Ashok Leyland has carved a niche for itself in the Indian truck industry. On the other hand, the place of pride belongs to Tata Motors for being the market leader. With the turnaround strategy of Tata Motors in place for the past over 1 year, and given the successful results, the company is quickly revamping its product portfolio to cater to fast-changing customer demands and to stay ahead of competition.